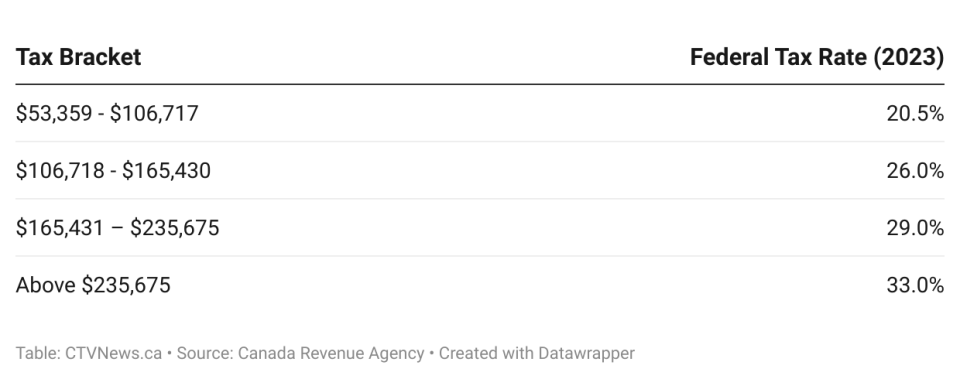

T4032NL-7 - Payroll Deductions Tables - Income tax deductions - Newfoundland and Labrador - Effective July 1, 2016

4915 week2 - notes - Agenda Setting up Payroll Non-regular payments Employment Income o Regular - Studocu

T4032-OC, Payroll Deductions Tables – CPP, EI, and income tax deductions – In Canada beyond the limits of any province/te

:max_bytes(150000):strip_icc()/payrollfiles-57a621f05f9b58974a262cf8.jpg)